13: linear regression with multiple predictors

STA35B: Statistical Data Science 2

Linear regression

Linear regression with multiple predictors

Multiple regression extends single predictor regression by allowing multiple predictors \(x_1, x_2, x_3, \ldots\)

\[y = b_0 + b_1 x_1 + b_2 x_2 + \cdots\]

- Data:

loans_full_schemadata with tidying

loans <- loans_full_schema |>

mutate(

credit_util = total_credit_utilized / total_credit_limit,

bankruptcy = as.factor(if_else(public_record_bankrupt == 0, 0, 1)),

verified_income = droplevels(verified_income)

) |>

rename(credit_checks = inquiries_last_12m) |>

select(interest_rate, verified_income, debt_to_income, credit_util, bankruptcy, term, credit_checks, issue_month)Linear regression with multiple predictors

loans |>

slice_head(n = 5) |>

kableExtra::kbl(linesep = "", booktabs = TRUE, align = "rlrrrr") |>

kableExtra::kable_styling(

bootstrap_options = c("striped", "condensed"),

latex_options = c("striped", "scale_down", "hold_position"),

full_width = FALSE

)| interest_rate | verified_income | debt_to_income | credit_util | bankruptcy | term | credit_checks | issue_month |

|---|---|---|---|---|---|---|---|

| 14.07 | Verified | 18.01 | 0.5475952 | 0 | 60 | 6 | Mar-2018 |

| 12.61 | Not Verified | 5.04 | 0.1500347 | 1 | 36 | 1 | Feb-2018 |

| 17.09 | Source Verified | 21.15 | 0.6613483 | 0 | 36 | 4 | Feb-2018 |

| 6.72 | Not Verified | 10.16 | 0.1967323 | 0 | 36 | 0 | Jan-2018 |

| 14.07 | Verified | 57.96 | 0.7549077 | 0 | 36 | 7 | Mar-2018 |

Linear regression with multiple predictors

| variable | description |

|---|---|

| interest_rate | Interest rate on the loan, annual percentage. |

| verified_income | Categorical var: whether the borrower’s income source/amount have been verified |

| debt_to_income | total debt of the borrower divided by their total income. |

| credit_util | what fraction of credit they utilizing |

| bankruptcy | Indicator 0/1: whether the borrower has a past bankruptcy in their record |

| term | The length of the loan, in months. |

| issue_month | The month and year the loan was issued |

| credit_checks | Number of credit checks in the last 12 months |

Indicators and categorical variables

Recall we fit a linear regression model w/ a categorical predictor with two levels:

[1] "0" "1"| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 12.338 | 0.053 | 231.490 | 0 |

| bankruptcy1 | 0.737 | 0.153 | 4.819 | 0 |

- Second term is called

bankruptcy1: refers to level “1”. The slope estimate is the estimated difference ininterest_rateof level “1” from level “0”. - Intercept estimate is the estimated

interest_ratefor “0” (reference level)

\[ \widehat{\texttt{interest_rate}} = b_0 + b_1 \times \texttt{bankruptcy} \]

Indicators and categorical variables

Let’s now consider a 3-level categorical variable like verified_income:

[1] "Not Verified" "Source Verified" "Verified" | term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 11.10 | 0.08 | 137.18 | 0 |

| verified_incomeSource Verified | 1.42 | 0.11 | 12.79 | 0 |

| verified_incomeVerified | 3.25 | 0.13 | 25.09 | 0 |

- Look at the names of second and third terms. Regression model equation is

\[\begin{align} \widehat{\texttt{interest_rate}} = 11.10 &+ 1.42 \times \texttt{verified_income}_{\texttt{Source Verified}} \\ &+ 3.25 \times \texttt{verified_income}_{\texttt{Verified}} \end{align}\]

Indicators and categorical variables

Regression model equation is

\[\begin{align} \widehat{\texttt{interest_rate}} = 11.10 &+ 1.42 \times \texttt{verified_income}_{\texttt{Source Verified}} \\ &+ 3.25 \times \texttt{verified_income}_{\texttt{Verified}} \end{align}\]

- The regression model equation now has two indicator variables: \[\texttt{verified_income}_{\texttt{Source Verified}} \qquad \text{and} \qquad \texttt{verified_income}_{\texttt{Verified}}\]

- Recall: the value of an indicator variable is either 0 or 1

Indicators and categorical variables

Regression model equation is

\[\begin{align} \widehat{\texttt{interest_rate}} = 11.10 &+ 1.42 \times \texttt{verified_income}_{\texttt{Source Verified}} \\ &+ 3.25 \times \texttt{verified_income}_{\texttt{Verified}} \end{align}\]

- Average interest rate for borrowers whose

verified_incomevalue is…

“Not Verified”:

\[\begin{align} 11.10 &+ 1.42 \times 0 \\ &+ 3.25 \times 0 \\ &= 11.10 \end{align}\]

“Source Verified”:

\[\begin{align} 11.10 &+ 1.42 \times 1 \\ &+ 3.25 \times 0 \\ &= 12.52 \end{align}\]

“Verified”:

\[\begin{align} 11.10 &+ 1.42 \times 1 \\ &+ 3.25 \times 1 \\ &= 15.77 \end{align}\]

Multiple predictors in a linear model

Suppose we want to construct model for interest_rate using not just bankruptcy, but also other variables:

\[\begin{align} &\widehat{\texttt{interest_rate}} = b_0 \\ &+ b_1 \times \texttt{verified_income}_{\texttt{Source Verified}} \\ &+ b_2 \times \texttt{verified_income}_{\texttt{Verified}} \\ &+ b_3 \times \texttt{debt_to_income} \\ &+ b_4 \times \texttt{credit_util} \\ &+ b_5 \times \texttt{bankruptcy} \\ &+ b_6 \times \texttt{term} \\ &+ b_7 \times \texttt{credit_checks} \\ &+ b_8 \times \texttt{issue_month}_{\texttt{Jan-2018}} \\ &+ b_9 \times \texttt{issue_month}_{\texttt{Mar-2018}} \end{align}\]

- Just as before, we find those \(b_0, \cdots, b_9\) such that the sum of squared residuals is small,

\[\begin{align} SSE = e_1^2 + \cdots + e_{10000}^2 = \sum_{i=1}^n e_i^2. \end{align}\]

Multiple predictors in a linear model

lm(response ~ .) to fit a linear model using ALL predictors except for response

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 1.89 | 0.21 | 9.01 | 0.00 |

| verified_incomeSource Verified | 1.00 | 0.10 | 10.06 | 0.00 |

| verified_incomeVerified | 2.56 | 0.12 | 21.87 | 0.00 |

| debt_to_income | 0.02 | 0.00 | 7.43 | 0.00 |

| credit_util | 4.90 | 0.16 | 30.25 | 0.00 |

| bankruptcy1 | 0.39 | 0.13 | 2.96 | 0.00 |

| term | 0.15 | 0.00 | 38.89 | 0.00 |

| credit_checks | 0.23 | 0.02 | 12.52 | 0.00 |

| issue_monthJan-2018 | 0.05 | 0.11 | 0.42 | 0.67 |

| issue_monthMar-2018 | -0.04 | 0.11 | -0.39 | 0.70 |

Multiple predictors in a linear model

The fitted model from previous slide has regression equation:

\[ \begin{aligned} &\widehat{\texttt{interest_rate}} = 1.89 \\ &+ 1.00 \times \texttt{verified_income}_{\texttt{Source Verified}} \\ &+ 2.56 \times \texttt{verified_income}_{\texttt{Verified}} \\ &+ 0.02 \times \texttt{debt_to_income} \\ &+ 4.90 \times \texttt{credit_util} \\ &+ 0.39 \times \texttt{bankruptcy} \\ &+ 0.15 \times \texttt{term} \\ &+ 0.23 \times \texttt{credit_checks} \\ &+ 0.05 \times \texttt{issue_month}_{\texttt{Jan-2018}} \\ &- 0.04 \times \texttt{issue_month}_{\texttt{Mar-2018}} \end{aligned} \]

Categorical predictors verified_income and issue_month: we have two coefficients for each.

- If a categorical predictor has \(p\) different levels, we get an additional \(p-1\) terms

- Effective \(\#\) of predictors grows with \(\#\) of levels in a categorical variable.

- 7 variables, but 9 predictors.

- Intercept term here is not interpretable; cannot set

term(=length of loan) to 0 in a meaningful way.

Multiple regression vs. single linear regression

- When we looked at

lm(interest_rate ~ bankruptcy), we found a coefficient of 0.74, while forlm(interest rate ~ .), we found a coefficient of 0.386 for bankruptcy. - This is because some of the variables are correlated: when just modeling interest rate as a function of bankruptcy, we didn’t account for role of income verification, debt to income ratio, etc.

- In general, correlation between variables complicates linear regression analyses and interpretation.

Adjusted R squared

Single-variable linear regression: \(R^2\) helps determine amount of variability in response explained by model

\[ \begin{aligned} R^2 &= 1 - \frac{\text{variability in residuals}}{\text{variability in the outcome}}\\ &= 1 - \frac{s_{\text{residuals}}^2}{s_{\text{outcome}}^2} \end{aligned} \]

- Easily extends to multiple linear reg.

- Issue: every additional predictor increases the \(R^2\), even if predictor is irrelevant to response

- What if we want to assess a model’s goodness of fit?

The adjusted \(R^2\) penalizes the inclusion of unnecessary predictors

- If there are \(k\) predictor variables in the model,

\[\begin{align} R_{adj}^{2} &= 1 - \frac{s_{\text{residuals}}^2 / (n-k-1)} {s_{\text{outcome}}^2 / (n-1)} \\ &= 1 - \frac{s_{\text{residuals}}^2}{s_{\text{outcome}}^2} \times \frac{n-1}{n-k-1} \end{align}\]

- (\(p\)-levels of categorical predictor \(\implies p-1\) predictor vars)

- Adjusted \(R^2\) \(\leq\) unadjusted \(R^2\)

–> –> –>

Model selection

Model selection

How do we decide which variables to include when devising a linear model?

- Generally referred to as “model selection” or “variable selection”.

- Could try assessing all \(2^p\) models, but often infeasible if \(p\) is large.

- Let’s instead try an approach called stepwise selection.

- backward elimination: start from a large model and remove variables one-at-a-time.

- forward selection: Start from a small model and add variables one-by-one.

- Different criteria can be used to guide whether to add/eliminate variables.

- We’ll mainly use adjusted R-squared \(R^2_{adj}\)

- improvement = larger adjusted R-squared

Model selection: backward elimination

lm(interest_rate ~ ., data=loans) results in a linear model with \(R^2_{adj} = 0.2597\), using variables verified_income, debt_to_income, credit_util, bankruptcy, term, credit_checks, issue_month.

- We then create new linear models where we remove exactly one variable, and we report adjusted \(R^2\) as:

- Excluding

verified_income: 0.2238 - Excluding

debt_to_income: 0.2557 - Excluding

credit_util: 0.1916 - Excluding

bankruptcy: 0.2589 - Excluding

term: 0.1468 - Excluding

credit_checks: 0.2484 - Excluding

issue_month: 0.2598

- Excluding

- Removing

issue_monthhas \(R^2_{adj}\) of 0.2598 > 0.2597, so we dropissue_monthfrom the model. - Now we have six variables.

- We then continue and see if also removing one of these six variables produces a larger adjusted \(R^2\).

- Repeat the process as long as the removal increases \(R^2_{adj}\).

Model selection: forward selection

Start with a model with no predictors. This always has \(R^2_{adj}=0\).

- Compare to models with a single variable each, which have \(R^2_{adj}\) of:

- Including

verified_income: 0.05926 - Including

debt_to_income: 0.01946 - Including

credit_util: 0.06452 - Including

bankruptcy: 0.00222 - Including

term: 0.12855 - Including

credit_checks: -0.0001 - Including

issue_month: 0.01711

- Including

termhas largest \(R^2_{adj}\), and is \(>0\), so we add this variable to the model

- Now let’s try adding another

verified_income: 0.16851debt_to_income: 0.14368credit_util: 0.20046bankruptcy: 0.13070credit_checks: 0.12840issue_month: 0.14294

- Adding

credit_utilyields largest \(R^2_{adj}\) increase, and is \(> 0.12855\), so add it to model as a predictor. - Repeat until \(R^2_{adj}\) stops improving.

Example: housing prices

Look at openintro::duke_forest dataset

- first few rows look like this

| price | bed | bath | area | year_built | cooling | lot |

|---|---|---|---|---|---|---|

| 1,520,000 | 3 | 4 | 6,040 | 1,972 | central | 0.97 |

| 1,030,000 | 5 | 4 | 4,475 | 1,969 | central | 1.38 |

| 420,000 | 2 | 3 | 1,745 | 1,959 | central | 0.51 |

| 680,000 | 4 | 3 | 2,091 | 1,961 | central | 0.84 |

| 428,500 | 4 | 3 | 1,772 | 2,020 | central | 0.16 |

| 456,000 | 3 | 3 | 1,950 | 2,014 | central | 0.45 |

| 1,270,000 | 5 | 5 | 3,909 | 1,968 | central | 0.94 |

| Variable | Description |

|---|---|

| price | Sale price, in USD |

| bed | # of bedrooms |

| bath | # of bathrooms |

| area | Area of home, in square feet |

| year_built | Year the home was built |

| cooling | Cooling system: central or other (other is baseline) |

| lot | Area of the entire property, in acres |

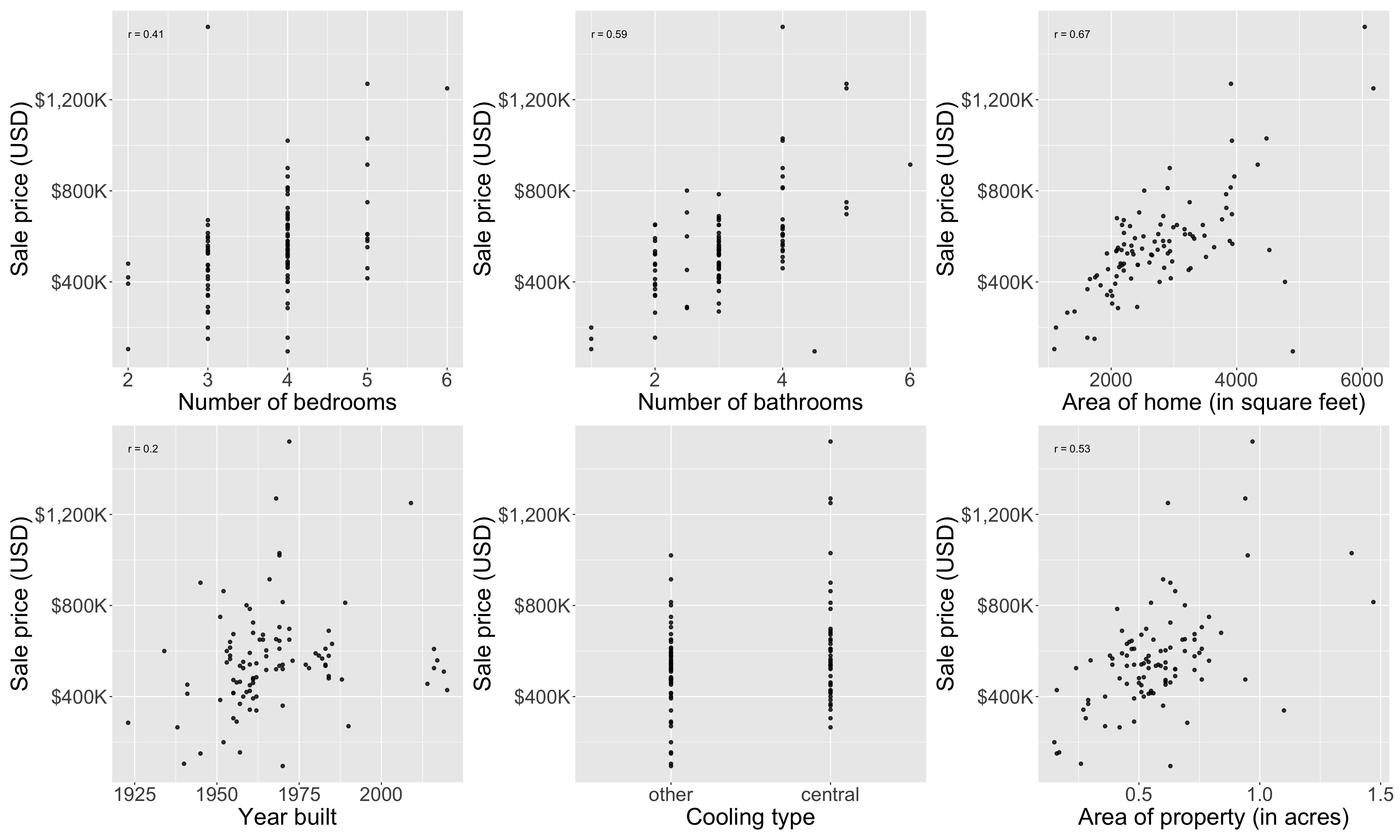

Example: housing prices

Let’s do some exploratory data analysis

Seems all variables are positively associated with price

Example: housing prices

Let’s now try to predict price from area: single linear regression

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | 116652.33 | 53302.46 | 2.19 | 0.03 |

| area | 159.48 | 18.17 | 8.78 | 0.00 |

- This gives the predictive model \[ \widehat{\mathsf{price}} = 116,652 + 159\times \mathsf{area}\]

- Each additional increase in area by one square foot is expected to increase a home’s price by $159

- Does appear to be a linear relationship, but residuals for expensive homes are quite large. Not clear that a linear model is the best model for large/expensive homes, need more advanced methods.

Modeling price with multiple variables

Now model price w/ multiple variables

m_full <- lm(price ~ area + bed + bath + year_built + cooling + lot, data = duke_forest)

m_full |> broom::tidy() |> kable(digits=0)| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -2910715 | 1787934 | -2 | 0 |

| area | 102 | 23 | 4 | 0 |

| bed | -13692 | 25928 | -1 | 1 |

| bath | 41076 | 24662 | 2 | 0 |

| year_built | 1459 | 914 | 2 | 0 |

| coolingcentral | 84065 | 30338 | 3 | 0 |

| lot | 356141 | 75940 | 5 | 0 |

- This forms the predictive model

\[\begin{align} \widehat{\texttt{price}} &= -2,910,715 \\ &\quad+ 102 \times \texttt{area} \\ &\quad- 13,692 \times \texttt{bed} \\ &\quad+ 41,076 \times \texttt{bath} \\ &\quad+ 1,459 \times \texttt{year_built}\\ &\quad+ 84,065 \times \texttt{cooling}_{\texttt{central}} \\ &\quad+ 356,141 \times \texttt{lot} \end{align}\]

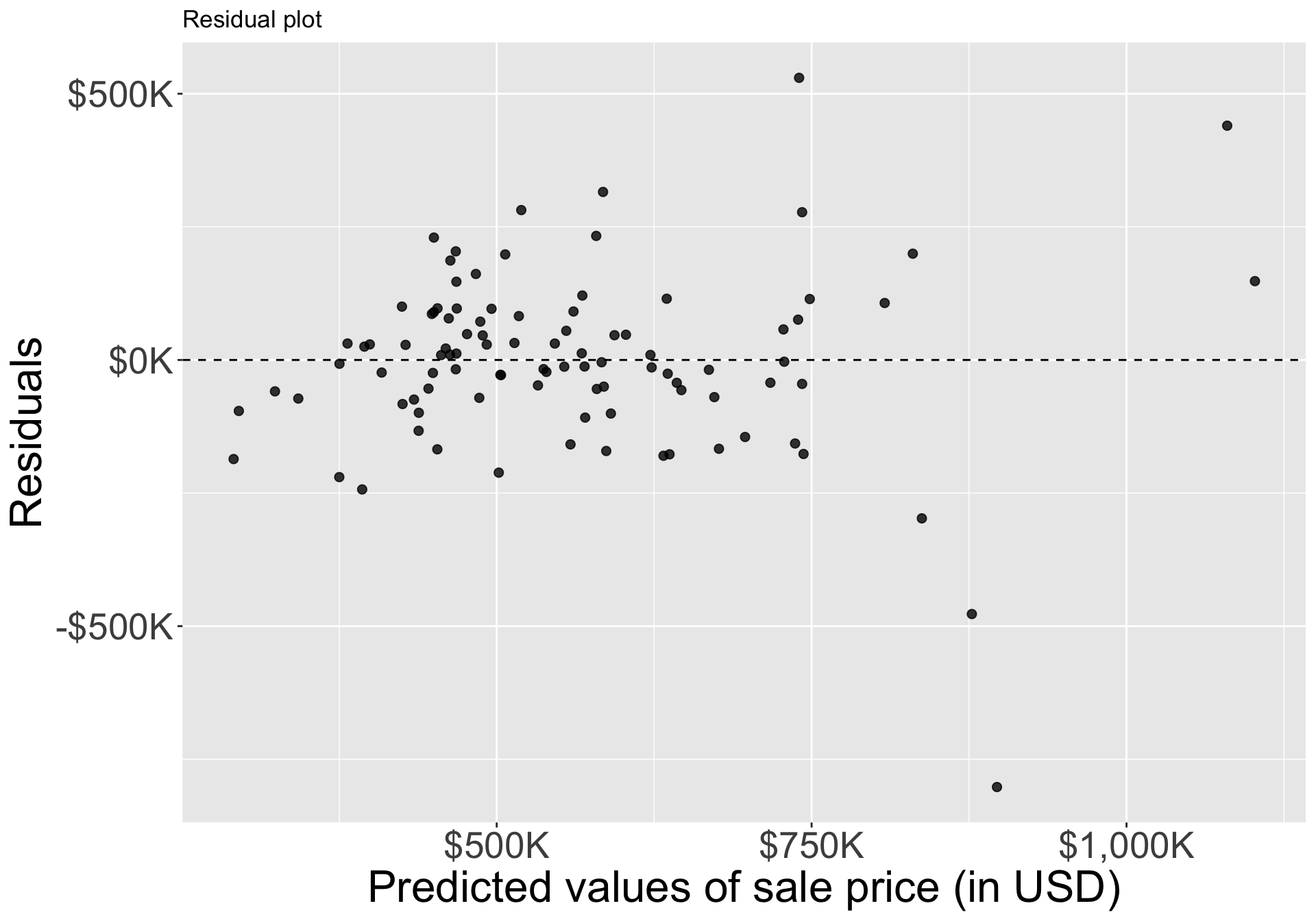

Modeling price with multiple variables

- Residuals appear to be randomly scattered around zero, but again pretty large residuals for expensive homes

- One apparent outlier at \(-\$750K\) predicted value.

Backward elimination

- Let’s see if excluding certain variables helps to improve the model’s \(R^2_{adj}\)

- Helpful function in R:

update() - Takes

lm()output and allows you to specify what changes you’d like to make . ~ . - variable<–> use same formula as before, but now removevariablefrom the formula

| term | estimate | std.error | statistic | p.value |

|---|---|---|---|---|

| (Intercept) | -3056731 | 1960957 | -2 | 0 |

| bed | 15103 | 27528 | 1 | 1 |

| bath | 91076 | 24034 | 4 | 0 |

| year_built | 1521 | 1002 | 2 | 0 |

| coolingcentral | 67210 | 33015 | 2 | 0 |

| lot | 447962 | 80120 | 6 | 0 |

- model summary omits

area

Backward elimination

- Baseline \(R^2_{adj}\) from the full model is 0.5896.

- Will dropping a predictor improve \(R^2_{adj}\)?

- Excluding

area: 0.5062 - Excluding

bed: 0.5929 - Excluding

bath: 0.5816 - Excluding

year_built: 0.5826 - Excluding

cooling: 0.5595 - Excluding

lot: 0.4894

Backward elimination

- Excluding

bedimproves adjusted \(R^2\), so we eliminate this- Excluding

bedandarea: 0.506 - Excluding

bedandbath: 0.586 - Excluding

bedandyear_built: 0.586 - Excluding

bedandcooling: 0.563 - Excluding

bedandlot: 0.493

- Excluding

- None of these improve on the (new) baseline adjusted \(R^2\) of \(0.593\), so we don’t change the model any more

Backward elimination

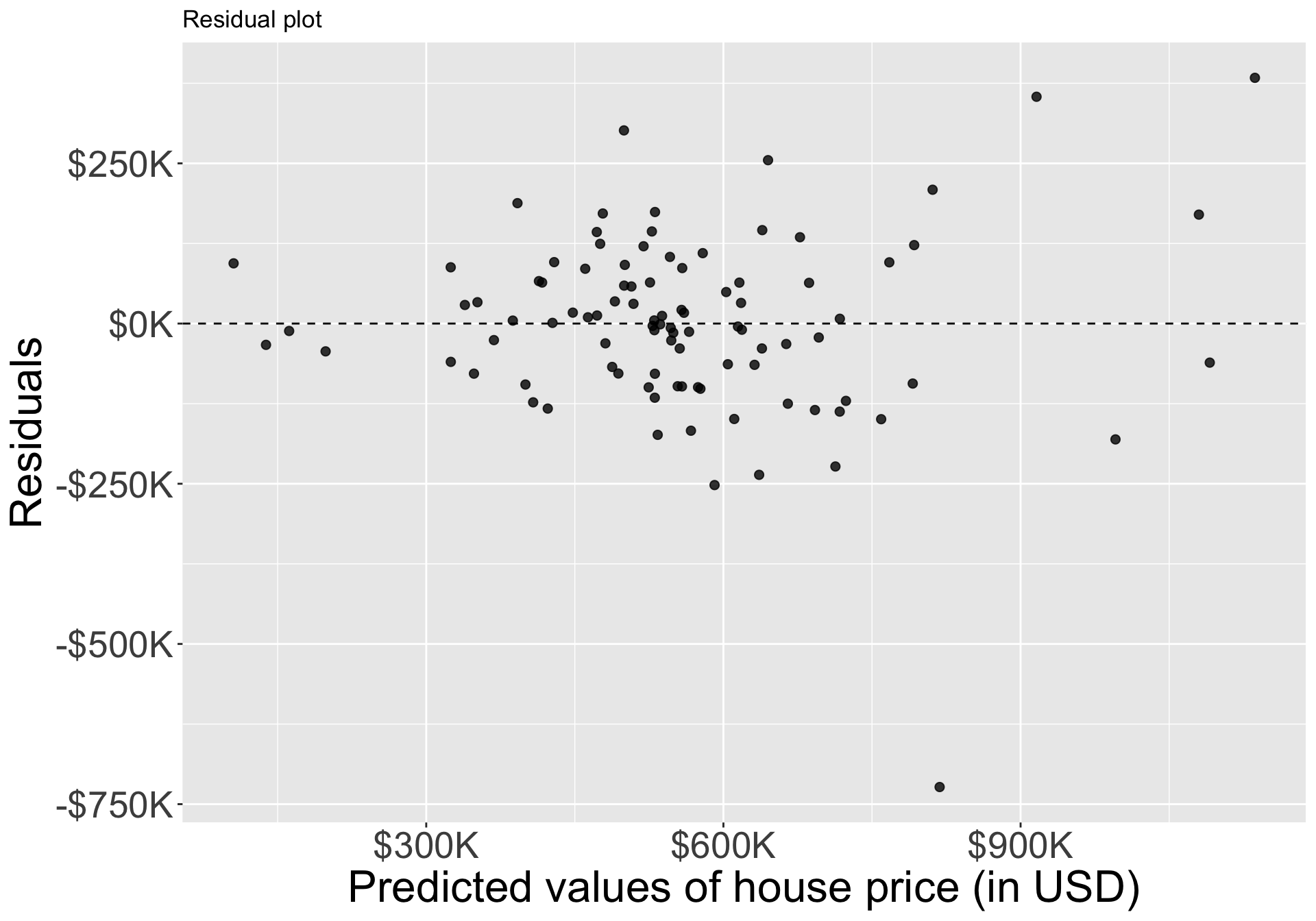

- Removing

bed, we have the following model:

m_full <- lm(price ~ area + bed + bath + year_built + cooling + lot, data = duke_forest)

update(m_full, . ~ . - bed, data = duke_forest) |> broom::tidy()# A tibble: 6 × 5

term estimate std.error statistic p.value

<chr> <dbl> <dbl> <dbl> <dbl>

1 (Intercept) -2952641. 1779079. -1.66 0.100

2 area 99.1 22.3 4.44 0.0000249

3 bath 36228. 22799. 1.59 0.116

4 year_built 1466. 910. 1.61 0.111

5 coolingcentral 83856. 30215. 2.78 0.00669

6 lot 357119. 75617. 4.72 0.00000841\[ \begin{aligned} \widehat{\texttt{price}} &= -2,952,641 + 99 \times \texttt{area}\\ &+ 36,228 \times \texttt{bath} + 1,466 \times \texttt{year_built}\\ &+ 83,856 \times \texttt{cooling}_{\texttt{central}} + 357,119 \times \texttt{lot} \end{aligned} \]

Automate this process

Backward elimination and forward selection are widely taught and have been around for a long time

- We stepped through this process to learn and understand the procedure

- Calculations and selections have been implemented in e.g., R package

olsrr

bcs pindex enzyme_test liver_test age gender alc_mod alc_heavy y

1 6.7 62 81 2.59 50 0 1 0 695

2 5.1 59 66 1.70 39 0 0 0 403

3 7.4 57 83 2.16 55 0 0 0 710- See olsrr vignette for more information about package

Automate this process: Backward elimination

Stepwise Summary

-------------------------------------------------------------------------

Step Variable AIC SBC SBIC R2 Adj. R2

-------------------------------------------------------------------------

0 Full Model 736.390 756.280 586.665 0.78184 0.74305

1 alc_mod 734.407 752.308 584.276 0.78177 0.74856

2 gender 732.494 748.406 581.938 0.78142 0.75351

3 age 730.620 744.543 579.638 0.78091 0.75808

-------------------------------------------------------------------------

Final Model Output

------------------

Model Summary

-------------------------------------------------------------------

R 0.884 RMSE 184.276

R-Squared 0.781 MSE 33957.712

Adj. R-Squared 0.758 Coef. Var 27.839

Pred R-Squared 0.700 AIC 730.620

MAE 137.656 SBC 744.543

-------------------------------------------------------------------

RMSE: Root Mean Square Error

MSE: Mean Square Error

MAE: Mean Absolute Error

AIC: Akaike Information Criteria

SBC: Schwarz Bayesian Criteria

ANOVA

-----------------------------------------------------------------------

Sum of

Squares DF Mean Square F Sig.

-----------------------------------------------------------------------

Regression 6535804.090 5 1307160.818 34.217 0.0000

Residual 1833716.447 48 38202.426

Total 8369520.537 53

-----------------------------------------------------------------------

Parameter Estimates

------------------------------------------------------------------------------------------------

model Beta Std. Error Std. Beta t Sig lower upper

------------------------------------------------------------------------------------------------

(Intercept) -1178.330 208.682 -5.647 0.000 -1597.914 -758.746

bcs 59.864 23.060 0.241 2.596 0.012 13.498 106.230

pindex 8.924 1.808 0.380 4.935 0.000 5.288 12.559

enzyme_test 9.748 1.656 0.521 5.887 0.000 6.419 13.077

liver_test 58.064 40.144 0.156 1.446 0.155 -22.652 138.779

alc_heavy 317.848 71.634 0.314 4.437 0.000 173.818 461.878

------------------------------------------------------------------------------------------------Automate this process: Forward selection

Stepwise Summary

--------------------------------------------------------------------------

Step Variable AIC SBC SBIC R2 Adj. R2

--------------------------------------------------------------------------

0 Base Model 802.606 806.584 646.794 0.00000 0.00000

1 liver_test 771.875 777.842 616.009 0.45454 0.44405

2 alc_heavy 761.439 769.395 605.506 0.56674 0.54975

3 enzyme_test 750.509 760.454 595.297 0.65900 0.63854

4 pindex 735.715 747.649 582.943 0.75015 0.72975

5 bcs 730.620 744.543 579.638 0.78091 0.75808

--------------------------------------------------------------------------

Final Model Output

------------------

Model Summary

-------------------------------------------------------------------

R 0.884 RMSE 184.276

R-Squared 0.781 MSE 33957.712

Adj. R-Squared 0.758 Coef. Var 27.839

Pred R-Squared 0.700 AIC 730.620

MAE 137.656 SBC 744.543

-------------------------------------------------------------------

RMSE: Root Mean Square Error

MSE: Mean Square Error

MAE: Mean Absolute Error

AIC: Akaike Information Criteria

SBC: Schwarz Bayesian Criteria

ANOVA

-----------------------------------------------------------------------

Sum of

Squares DF Mean Square F Sig.

-----------------------------------------------------------------------

Regression 6535804.090 5 1307160.818 34.217 0.0000

Residual 1833716.447 48 38202.426

Total 8369520.537 53

-----------------------------------------------------------------------

Parameter Estimates

------------------------------------------------------------------------------------------------

model Beta Std. Error Std. Beta t Sig lower upper

------------------------------------------------------------------------------------------------

(Intercept) -1178.330 208.682 -5.647 0.000 -1597.914 -758.746

liver_test 58.064 40.144 0.156 1.446 0.155 -22.652 138.779

alc_heavy 317.848 71.634 0.314 4.437 0.000 173.818 461.878

enzyme_test 9.748 1.656 0.521 5.887 0.000 6.419 13.077

pindex 8.924 1.808 0.380 4.935 0.000 5.288 12.559

bcs 59.864 23.060 0.241 2.596 0.012 13.498 106.230

------------------------------------------------------------------------------------------------Automate this process: make it prettier

| step | variable | adj_r2 |

|---|---|---|

| 1 | liver_test | 0.444 |

| 2 | alc_heavy | 0.550 |

| 3 | enzyme_test | 0.639 |

| 4 | pindex | 0.730 |

| 5 | bcs | 0.758 |

- Make prettier by changing

adj_r2to “Adjusted \(R^2\)”, etc. - Function

kable()comes from packagekableExtra. - See package

kableExtrafor more functionality.

Final comments on model selection

There are many commonly used model selection strategies.

- E.g., stepwise selection can also be carried out with decision criteria other than adjusted \(R^2\) such as p-values, or AIC (Akaike information criterion), or BIC (Bayesian information criterion), which you might learn about in more advanced courses.

- Alternatively, one could include / exclude predictors from a model based on expert opinion or due to research focus.

- Many statisticians discourage the use of stepwise regression alone for model selection and advocate, instead, for a more thoughtful approach that carefully considers the research focus and features of the data.